Roth Income Limits 2025 Married Filing Joint

Roth Income Limits 2025 Married Filing Joint. Your total contribution can’t be more than your joint taxable income or two times the annual contribution limit. The income limit to contribute the full amount to a roth ira in 2025 is $146,000, up from $138,000 in 2025.

The income limit to contribute the full amount to a roth ira in 2025 is $146,000, up from $138,000 in 2025. 12 rows if you file taxes as a single person, your modified adjusted gross income.

rothiramarriedfilingjointly, For taxpayers 50 and older, this limit increases to $8,000. Married filing jointly or qualifying widow(er) less.

Married Filing Joint Tax Brackets 2025 Ranee Rozella, After your income surpasses that, you'll enter the. You can’t make a roth ira contribution if your modified agi is.

Married Filing Joint Tax Bracket 2025 Joell Madalyn, This is up from the ira. If you were 50 or older by the end of 2025, the contribution limit.

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, Start with your modified agi. You file single or head of household and have an agi of less than $146,000.

Tax Requirements 2025 Willi Corinne, Filing status 2025 modified agi 2025 modified agi contribution limit; Subtract from the amount in (1):

The IRS announced its Roth IRA limits for 2025 Personal, Filing status 2025 modified agi 2025 modified agi contribution limit; In 2025, single filers making less than $161,000 and those married filing jointly making less than $204,000 are.

Roth Limits 2025 Theo Ursala, Roth ira income and contribution limits for 2025; The exception is if your joint income is now higher than the income limits for roth iras set by the internal revenue service (irs) for couples filing jointly:

2025 Tax Brackets Irs Married Filing Jointly • Trend 2025, See how much you can contribute to an ira this year. The annual contribution limit for a roth ira is $6,500 for 2025.

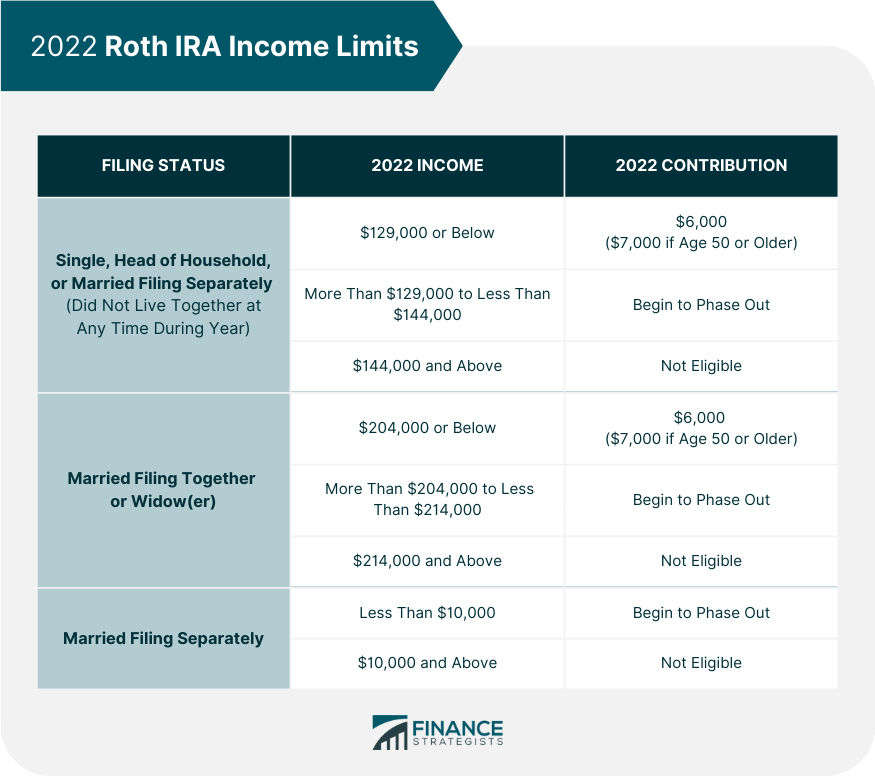

IRA Contribution Limits 2025 Finance Strategists, For those married filing jointly, the income range to contribute a portion of the full amount is $230,000 or more, but less than $240,000. You’re married filing jointly or a qualifying widow (er) and have an adjusted gross income (agi) of less than $230,000.

What is a Roth IRA? The Fancy Accountant, If a couple’s combined magi is $230,000 or less in 2025, they may. To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last.

$10,000 if you’re filing a joint return, a qualifying widow(er), or married filing a separate return and you lived with your spouse during the year.