Personal Gift Limit 2025

Personal Gift Limit 2025. If a gift exceeds the $18,000 limit for 2025, that does not automatically trigger the gift tax. For married couples, the limit is $18,000 each, for a total of $36,000.

The annual exclusion applies to gifts to each donee. The proposal aims to decrease the federal deficit by roughly $3 trillion.

IRS Increases Gift and Estate Tax Thresholds for 2025, Washington — the internal revenue. In 2025, the annual limit is $18,000 per recipient.

401(k) Contribution Limits for 2025, 2025, and Prior Years, The 2025 gift tax limit is $18,000. This means you can give up to $18,000 to as.

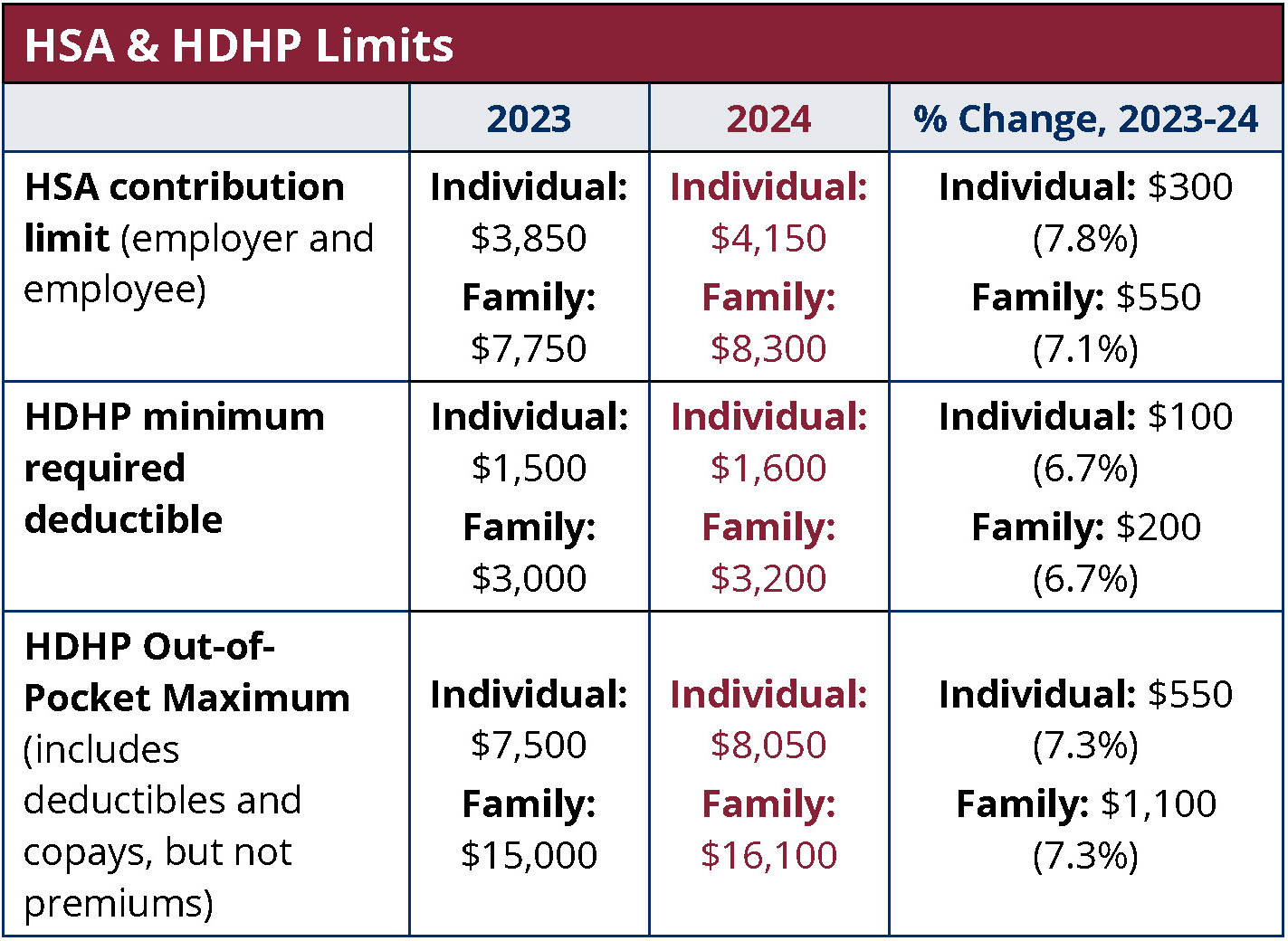

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Gifts given less than 7 years before you die may be taxed depending on: Washington — the internal revenue.

IRS Gift Limits From Foreign Persons 2025, For 2025, the annual gift tax limit is $18,000. Make your money work for you.

New HSA/HDHP Limits for 2025 Miller Johnson, To illustrate, an individual could distribute $17,000 to. Interest, dividends, other types of income.

Significant HSA Contribution Limit Increase for 2025, Who you give the gift to and their relationship to you. Gifting more than this sum.

The IRS just announced the 2025 401(k) and IRA contribution limits, For married couples, the limit is $18,000 each, for a total of $36,000. The proposal aims to decrease the federal deficit by roughly $3 trillion.

California Raises Campaign Contribution and Gift Limits for 20232024, The irs excludes certain types of gifts from being taxable: This means you can give up to $18,000 to as.

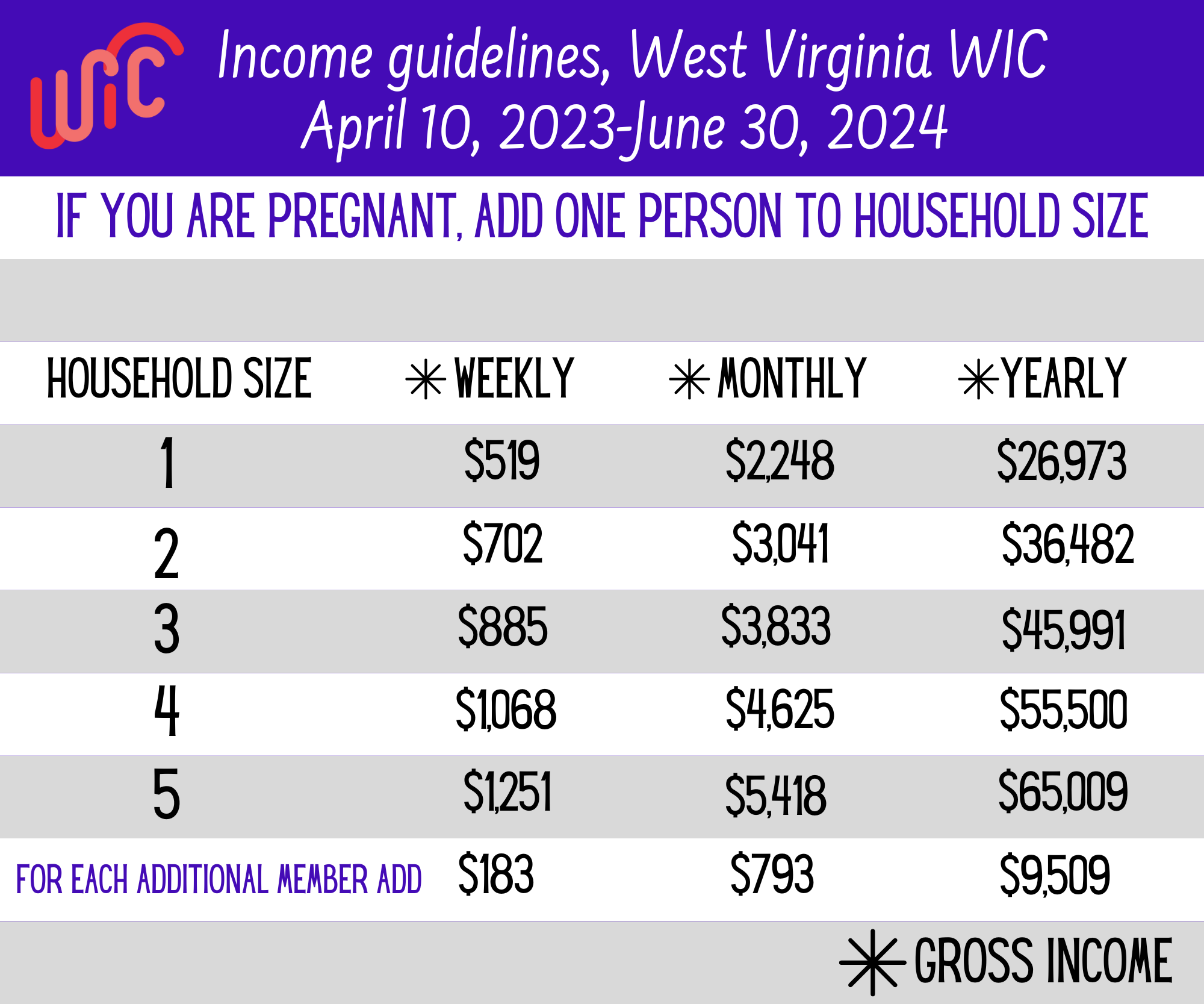

WIC Eligibility Guidelines Monongalia County Health Department, Washington — the internal revenue. The annual exclusion applies to gifts to each donee.

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, Not all gifts are taxable. Is it better to gift or inherit money?